Consumer Insurance Fraud: Crime Involving Submission of Insurance Claims

Posted on by Michael Lowe.

Anyone applying for insurance or submitting an insurance claim seeking payment pursuant to provisions of an insurance policy can be arrested and charged for insurance fraud under Texas Penal Code Section 35.02.

In Texas, insurance fraud is prosecuted by the local District Attorney’s Office working with the Texas Commission on Law Enforcement (TCOLE) and the Texas Department of Insurance as well as other law enforcement officials investigating and charging for violations of Chapter 35 of the Texas Penal Code.

Convictions for insurance fraud can range from life imprisonment (1st Degree Felony) to as little as six months in jail (State Jail Felony) or payment of a monetary fine based upon violations of the state statutes alone. Combined with other criminal charges, or coupled with federal allegations, the insurance fraud arrest can mean a defendant losing their freedom for the rest of their lifetimes.

Types of Insurance Fraud

There are a wide variety of situations which police and prosecutors can argue constitute “insurance fraud” under the law. Both individuals and companies can be charged with this type of crime as a violation of the Texas Penal Code.

Insurance Fraud by Insurance Agents

For instance, the Texas Department of Insurance reports the case of Texas licensed insurance agent James Halsell as one of its top insurance fraud cases of 2017. Mr. Halsell was sentenced to 5 years in prison and ordered to pay restitution after being convicted of using a fraud scheme where he used fake, Social Security numbers, dates of birth, and addresses in order to apply for life insurance policies. He benefited by collecting commissions for the policy sales.

Another Top Insurance Fraud case of 2017 for the Texas Department of Insurance involved San Antonio insurance agent Paula Villareal being sentenced to 7 years’ incarceration as well as payment of restitution after she talked clients into rolling their retirement funds into IRAs, where she then transferred the IRA deposits into her personal account.

These are instances of insurance fraud involving insurance professionals. Many people are shocked to discover they are being investigated or charged as individuals who have violated the consumer insurance fraud provisions of Texas Penal Code Section 35.02.

Consumer Insurance Fraud

Consumer insurance fraud involves someone either (1) applying for insurance coverage or (2) submitting an insurance claim for damages with the “intent to defraud or deceive” the insurance company.

- Seeking Payment

Under Texas Penal Code Section 35.02, this can involve a claim for payment where the charge includes:

- Preparing a statement, or causing a statement to be prepared, that the accused knows contains false or misleading material information which is presented to the insurance company; or

- Presenting a statement to an insurance company, or causing it to be presented, that the accused knows contains false or misleading material information.

Texas Penal Code Section 35.02(a).

- Getting a Benefit

It is also considered to be consumer insurance fraud if the person receives a benefit where (a) with intent to defraud or deceive an insurance company, the person (1) solicits, (2) offers, (3) pays, or (4) receives (b) a benefit in connection with the furnishing of goods or services for which a claim for payment is submitted under an insurance policy.

Texas Penal Code Section 35.02(b).

Consumer Insurance Fraud: Property Insurance

Consumer insurance fraud claims can involve policies providing coverage for property or casualty. Here, the fraud is based upon things alleged harms like:

- Hail damage (or other kinds of weather events, like hurricanes or tornadoes);

- Arson;

- Car Accidents;

- Stolen Vehicles;

- Slip and Fall Injuries; or

- Burglary.

For example, in a false burglary report there may be a claim for things to have been stolen which were never lost (padded claim) as well as an entirely staged burglary of the home or business.

A fraud charge may also be based upon someone who files a claim for a stolen car which has never been stolen, or for injuries sustained in slip and falls on the claimant’s premises or in a car crash which are exaggerated or totally false.

Example: Jewelry Fraud Claim

A recent example of a conviction for violation of Texas Penal Code 35.02 in a property insurance claim can be found in the Fort Worth case of Florez v. State, No. 02-16-00195-CR (Tex. App. June 8, 2017).

In Florez, Herman Florez was found guilty by a jury of insurance fraud between $20,000 and $100,000, as well as fraudulent use or possession of identifying information. The judge sentenced Mr. Florez to 10 years incarceration for the insurance fraud (two years on the other charge) and then suspended the sentences, placing Florez on five years’ community supervision. The judge’s determinations were affirmed on appeal.

What had Mr. Florez done? He had gone through a divorce, and in the process he filed a claim (and submitted a police report) against a homeowner’s insurance policy for six pieces of his soon-to-be ex-wife’s jewelry he alleged had mysteriously disappeared (from their being lost or stolen, maybe by the moving company), along with three of his rings. Jennifer Florez later testified that the statements Florez made to Allstate regarding the jewelry were false and that he knew that their jewelry was kept in the safe at her mother’s house.

Consumer Insurance Fraud: Medical Insurance

Some insurance fraud cases are based upon medical insurance policies. Here, the fraud is based upon claims for monetary damages that can involve:

- Upcoded claims

- Unbundled claims

- False diagnosis

- False treatment

- Duplicate claims.

While many insurance fraud cases are prosecuted under federal laws involving Medicare or Medicaid fraud claims, there are independent state criminal charges that can be filed for medical insurance claim fraud.

Example: $3,900,000 Medical Provider Claims

For instance, the Texas Department of Insurance describes the 2016 arrest of Mark Allen Cox on allegations that Mr. Cox submitted over $3.9M in medical insurance claims for treatment allegedly provided by licensed medical providers. It was shown there was no licensed health care provider involved in the treatment. Cox entered into a plea deal on first degree felony charges of insurance fraud, and was sentenced to 10 years deferred adjudication probation. He was also ordered to pay $1.07M as restitution.

Consumer Insurance Fraud: Life or Disability Insurance

Life insurance policies or coverage for disability can also be the basis for a consumer insurance fraud allegation. Here, there will be allegations that can involve:

- Working while accepting disability payments;

- Faking disability (this can include forged documents from physicians, etc., to support the claim);

- Murder for profit (insurance proceeds).

Example: Life Insurance Murder for Hire

A notorious Texas murder-for-hire motivated by life insurance fraud made international headlines as the hit man in the killing of Theresa Rodriguez was executed in March 2017. See, “Hitman is executed in Texas for insurance fraud murder after Supreme Court rejects last-minute appeal,” published by the United Kingdom’s Daily Mail on March 8, 2017. The husband, who sought the death of his wife in order to obtain life insurance proceeds, made a plea deal for life imprisonment.

Sentencing Range: Misdemeanor to Life Imprisonment

The range of punishment that someone convicted of consumer insurance fraud can face is wide ranging, depending upon the amount involved in the fraud. The more money is involved in the fraud, the harsher the punishment.

Misdemeanor Up to $2499 in Consumer Insurance Fraud

For example, the individual will only face misdemeanor charges for small fraud claims:

- Class C misdemeanor if the value of the claim is less than $100;

- Class B misdemeanor if the value of the claim is $100 or more but less than $750;

- Class A misdemeanor if the value of the claim is $750 or more but less than $2,500.

Felony If $2499 or More in Consumer Insurance Fraud

He will face some jail time upon conviction for a state jail felony if the value of the claim is $2,500 or more but less than $30,000, and there will be more serious felony convictions as the fraudulent amount increases:

- felony of the third degree if the value of the claim is $30,000 or more but less than $150,000;

- felony of the second degree if the value of the claim is $150,000 or more but less than $300,000; or

- felony of the first degree if: (a) the value of the claim is $300,000 or more; or (b) an act committed in connection with the commission of the offense places a person at risk of death or serious bodily injury.

In addition to be sentenced to time behind bars, the judge can also order the payment of restitution, court costs, and attorneys’ fees to the insurance company that is found to be a victim of fraud.

Defenses to Allegations of Consumer Insurance Fraud

From a criminal defense standpoint, allegations of consumer insurance fraud must be carefully reviewed, and often distinguished from other allegations of criminal acts that are filed alongside the fraud charges.

Is There Factual Support for the Element of Intent?

The prosecutor’s charges must be considered. Are there facts to support the cornerstone of any fraud allegation: i.e., that there was any intent on the part of the accused to deceive or defraud anyone? Are there additional facts that can be presented to demonstrate the lack of this intent? Without evidence of intent to defraud or deceive, the charges cannot survive and must be dropped or dismissed.

Is the Claim Really False or Fraudulent?

Another defense strategy will be to delve into the alleged “falsehood” of the insurance claim or application. What is supposed to be phony here? Is it really? Are there additional circumstances that can explain things?

Was a Mistake Made in the Insurance Claim?

Maybe things are awry in the claim. The prosecutor is sure that this was done on purpose – but what if the accused made a mistake? What if the hail damage was submitted regarding the wrong car, or if the claim is wrong about the inherited rings stored away for sentimental reasons but rarely worn and barely remembered?

TPC 35.02 Statutory Defense

Evidence of a valid claim is at least a partial defense provided within the language of Texas Penal Code Section 35.02.

Under Texas Penal Code Section 35.02(g), the accused may defend against the charges with a preponderance of the evidence that (1) at least a portion of the claim for payment under an insurance policy resulted from a valid loss, injury, expense, or service covered by the policy, and that (2) the value of the claim is equal to the difference between the total claim amount and the amount of the valid portion of the claim.

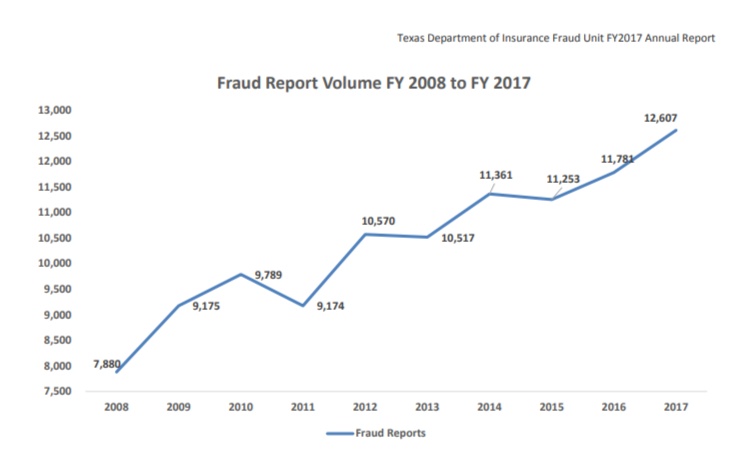

Statistics Regarding Insurance Fraud in Texas

According to the December 2017 Annual Report of the Texas Department of Insurance’s Fraud Unit to the State Insurance Commissioner, the Texas fraud investigators opened almost 500 cases for investigation (490), and referred almost 100 to prosecutors for charges to be filed (94). They obtained $2.3M in restitution as a result of their efforts last year, with 97 judgments being entered against defendants in the fraud cases that were prosecuted.

The Coalition Against Insurance Fraud focuses on the costs of insurance fraud, particularly insofar as how it impacts insurance carriers and their policy holders. Their industry research reports:

- Insurance Fraud takes $80B annually from American insurance companies;

- Insurance Fraud is estimated to be involved in 10% of all property insurance claims;

- Property and Casualty Insurance Fraud is estimated to cost carriers around $34,000,000,000.00 each year;

- Over half (57%) of insurance companies believe there will be even more Property Insurance Fraud committed by policy holders;

- Over half (58%) of insurers predict a steady increase in auto accident insurance fraud by policy holders;

- Almost two-thirds (69%) of insurance companies predict a rise in workers-compensation scams, where people fake disabilities to avoid work.

Insurance Fraud is Skyrocketing in Texas: Fraud Unit of the Texas Department of Insurance FY 2017 Annual Report.

Insurance Companies on the Hunt for Consumer Insurance Fraud

Clearly, when billions of dollars are at stake and the numbers are rising in fraudulent dollars being paid out by insurance companies, their efforts to find fraud and report it to the authorities will be increasing. Insurance companies are extremely motivated to try and limit the amount of money they are paying in fake insurance claims, and they have the manpower and resources to delve into claims and applications in ways that state agencies and local law enforcement cannot.

As a result, for many who will be accused of consumer insurance fraud in the future, their troubles may begin with a suspicious insurance carrier. Make no mistake: the insurance industry is monitoring consumer claims very closely for any hint of consumer insurance fraud.

For example, they are analyzing medical expenses in auto accident claims submitted by those who have been hurt in a car crash. Their statistics show the medical expenses are rising while the severity of motor vehicle accident personal injuries declines. Specifically (from data compiled by the Insurance Research Council in March 2014):

- There was an 8% increase in the average personal injury claim amount submitted between 2007 to 2012 covering medical costs and lost wages, etc.

- There was a corresponding 4% increase in the number of personal injury claimants.

In consideration of these two statistics, they suggest that with “… measures such as claimants with no visible injuries at the accident scene suggest a continuing decline in severity of injuries.”

The insurance industry is on the lookout for fraudulent claims and consumer insurance fraud. They are using things like automated claim systems to investigate potential fraud, as well as predictive modeling and other sophisticated measures. For details on the insurance industry’s consumer insurance fraud technologies, read The State of Insurance Fraud Technology prepared by Coalition against Insurance Fraud.

Obviously, it will not be surprising to discover that many of the consumer insurance fraud representations by criminal defense lawyers in Texas will originate in the offices of an insurance carrier.

Many of these consumer fraud cases begin with the insurer questioning what is being presented to them for payment.

Why? The insurance industry has both the incentive and the innovation to investigate claims for consumer insurance fraud in ways state law enforcement cannot. The criminal fraud proceeding may begin with a handoff by the private insurance company to the state law enforcement authority for prosecution as criminal consumer insurance fraud.

When Should You Be Concerned You Are Suspected of Consumer Insurance Fraud?

For those who are filing insurance claims or submitting applications for coverage, there should be a concern and warning when any insurance adjuster contacts them and begins asking questions. It will not matter how friendly they are, or how honest you have been.

Expect the insurance adjuster to record all communications and phone calls. Expect the insurance adjuster to assume there has been wrongdoing.

It does not matter whether or not you are innocent of wrongdoing. The insurance carrier will be working hard to try and build a fraud case because all too often fraud is assumed in any claim submission that is other than the most routine of claims requests.

If you have been approached in any way by an insurance agent, an insurance adjuster, or an insurance company investigator and you are being asked questions about your claim for damages based upon a property insurance policy, an auto policy, or home owner’s coverage, you need to consider whether or not they suspect you have committed consumer insurance fraud.

At any time, they may take their suspicions to law enforcement, where a criminal prosecution can begin.

Consequently, it is very important to consider hiring an experienced criminal defense lawyer with knowledge of white collar crime allegations and fraud prosecutions to help protect you and your loved ones as soon as you suspect that you are the target of a fraud investigation by the insurance company.

_____________________________________

For more information, check out our web resources, read Michael Lowe’s Case Results, and read his in-depth article, “Pre-Arrest Criminal Investigations.”

Comments are welcomed here and I will respond to you -- but please, no requests for personal legal advice here and nothing that's promoting your business or product. Comments are moderated and these will not be published.

Leave a Reply