WHY DENNIS HASTERT WILL PLEAD GUILTY AND MAY GET PROBATION

Posted on by Michael Lowe.

I have been following the Dennis Hastert case carefully. I know a lot about the so called “structuring” violation and the 18 USC 1001 violations, since I’ve defended these cases many times in Federal Court.

Dennis Hastert: Official Photo from the 109th Congress

Based on my reading of the indictment and the other facts which have become known to the public about this case, I have some opinions which aren’t in step with some of the so called expert legal commentators I’ve read about this case.

Let’s start with the Indictment.

Indictment of Dennis Hastert – May 2015

John Dennis Hastert is charged with two counts. The indictment alleges that Hastert withdrew a total of $1,700,000 over a four year period. The cash was to be used to pay-off “Individual A” to keep this person from speaking out about Hastert’s prior misconduct against Individual A. We now can safely assume this misconduct is a sexual assault on at least one of Hastert’s former students during the time Hastert was a teacher in Yorkville, Illinois.

This creepy caller named “Bruce” called his buddy from Yorkville, Denny, while he was making an appearance on CSPAN. This call is very creepy and it was posted on the same day old Denny was indicted on this case. Also, notice the language the AUSA is using in his indictment here. The prosecutor is NOT calling this person “Witness A.” This will become VERY important later on and could prove the difference between old Denny not spending any time in a Bureau of Prisons Correctional Facility.

Count One: Lying to the FBI

Count One

The first Count in the indictment is the “Martha Stewart” violation of 18 U.S.C. 1001(a)(2). This is the same law Martha Stewart was accused of violating and then found guilty after a jury trial. In this case, the Government need only prove that there was a matter within the jurisdiction of the executive, legislative or judicial branch of the Government for the United States and Hastert made any materially false, fictitious, or fraudulent statement to law enforcement. In this case, the FBI began investigating cash withdrawn from a few different banks belonging to Hastert. The investigation began for five different reasons:

- The FBI wanted to know whether Dennis Hastert was withdrawing cash in increments under the Federal Currency Transaction Report (“CTR”) requirement (cash withdrawn or deposited in excess of $10,000).

- The FBI thought that Hastert might have been using the large cash withdrawn from the Banks to cover up past criminal activity.

- The FBI needed to know whether Hastert was using the cash to further some other illegal activity.

- The FBI also felt the need to know whether Hastert was a victim of a criminal extortion scandal related to his past service in Congress and as Speaker of the House.

- Finally, the FBI held out the possibility that Hastert was using the cash for a lawful purpose.

The FBI interviewed Hastert to follow up on these five theories in their file. It is not clear to me whether Hastert had an attorney before this interview.

In my view, he should have had an attorney. And, if he had an attorney, that attorney shouldn’t be practicing criminal law, in my opinion. The FBI wanted to know what the money was for. Hastert said simply “Yeah . . . I kept the cash. That’s what I’m doing.” In my opinion, the FBI already knew what the cash was being used for. I really don’t think luck conspired against old Denny here. I really believe that Individual A had already made a report to law enforcement about the payoff scheme. Perhaps he felt he could keep the cash and also reap a reward for being an informant against someone else who violated the structuring laws; 31 USC 5324 and 5322. In fact, 31 USC 5323, allows the informer to get up to 25% of the fine or forfeited moneys paid in connection with the case. On the other hand, maybe the FBI set up surveillance on Hastert and watched him withdraw the cash and followed him directly to individual A. This information isn’t public yet. It’s clear that when Denny lied, he tried to make the cash hide. A violation of 18 USC 1001 can carry up to five years in the Bureau of Prisons as it is alleged in this case.

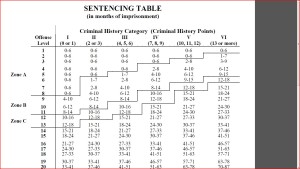

How would Denny be sentenced on the Martha Stewart violation? If we look at USSG 2J1.2 we can see that the base offense level would be 14 if he were found guilty. If he accepts responsibility in a timely manner he can get up to 2 more levels off his sentence pursuant to USSG 3E1.1. This would put Hastert at a level 12 and criminal history category I. The current USSG table recommends a 10-16 month sentence. This is zone C, so the sentence could be served in a combination of the BOP and a halfway house, but probation is much less likely. Here is portion of the current sentencing table:

Of course, if you are still reading, you would be asking me: Why do you think old Denny will plead guilty if he’s likely headed to the Pen anyway? It’s been my experience that Federal Prosecutors use the Martha Stewart, 1001, violation to get folks to plead guilty to another count. The 1001 violation is there just for leverage.

It’s clear to me that the AUSA here has a slam dunk case, but it’s not the 1001 violation. There’s legitimate questions about whether Denny’s statement was really even material. For example, it’s very likely the Feds already knew about the pay-off scheme when they interviewed Denny. And if they did, they would know that what Denny was doing with the cash was likely legal (even though it’s scummy). So, the FBI likely knew they ONLY had old Denny on a structuring case when they interviewed him. If that’s the case, then the structuring itself is the violation. Anything that happens with the cash later on is totally irrelevant to a structuring investigation.

As Hillary would say, “What difference does it make” what Denny did with the money? That leads us to the structuring count. Because this is where folks get very confused about the law and what the Government needs to prove versus what the General Public thinks the Government should have to prove.

Second Count

The Second Count on the Indictment is a violation of 31 USC 5324(a)(3). This is the so called “Structuring” law. The main portion of this law sets the maximum penalty at five years. However, there is such a thing as “Aggravated Structuring” which carries a penalty of up to ten years. The basic ranges of punishment are all laid out in 31 USC 5322 . For this case to be an Aggravated Structuring case, the Government would need to establish that the structuring activity was directly connected with some other illegal purpose or scheme and the structuring involved more than $100,000 over a 12 month time frame.

The indictment claims Hastert Structured $952,000 over four years. I don’t think the $100,000 element would be a problem for the Government if they chose to go for an Aggravated Structuring case. However, there seems to be no evidence that Hastert used the funds for any illegal purpose. Of course, the Government may disagree with that at sentencing but that’s going to be a different issue and I will discuss it later on when I get in to USSG applications for this case.

Bottom line, the Government isn’t alleging Aggravated Structuring; yet. So Denny is looking a maximum of five years. Typically, when multiple counts are alleged in a single indictment and the conduct is related the same transaction, then the Sentencing judge will likely “group” the counts together so that the sentences aren’t stacked. So it’s unlikely Denny will need to be concerned about a really huge sentence in this case. However, if the AUSA drops Count one in exchange for a guilty plea to Count Two, Denny may very well get probations with a sprinkling of home confinement. Here’s how it may go down.

USSG 2S1.3 sets out the guideline calculation for Count Two in Hastert’s indictment. Now, folks may be asking me; How can you be so sure Hastert won’t go to trial and be found not guilty? My answer is that he may not be found guilty on Count One, but he will certainly get convicted of at least one act of structuring. The structuring law prohibits individuals from either making a cash deposit at a bank or a cash withdrawal at a bank so as to cause the banking institution to not file a CTR. Banks are required to prepare and file with the Financial Crimes Enforcement Network a Currency Transaction Report (form 104) for any transaction or series of transactions involving currency of more than $10,000. Almost all of the structuring cases I’ve ever seen involve cash deposits. The reason is usually simple tax evasion. The usual case involves someone who accumulates a large amount of cash from a lawful business. The cash isn’t claimed as income because the taxpayer doesn’t like paying taxes so much he/she is willing to go to jail for nonpayment. So, the clever taxpayer decides to keep the Government in the dark by making cash deposits in various bank accounts in increments under the $10,001 trigger. However, the law also prohibits folks from doing the very same thing with withdrawals. It’s not very common, but it is just as unlawful as structuring deposits. Here is a good paper on Structuring I’ve written which laws out the basic types of structuring cases and how they really work in Federal Court.

But you might ask: the Government can’t prove why old Denny withdrew the money. Maybe Denny decided the world was coming to an end and none of the banks could be trusted anymore!!

Maybe Denny was going to use that cash as a reserve for his end-of-days prophecy camp. You know, he was planning to move into an Earthship and live off the grid in New Mexico. The problem with that is all of that evidence stuff. For example, Denny made 15 $50,000 cash withdrawals from Old Second Bank, People’s State Bank and Castle Bank from 2010 to 2012. This cash was provided to Individual A every six weeks. In April 2012, bank representatives began questioning Denny about the withdrawals pursuant to policy. It’s been my experience that Bank employees are trained to notify the banking customer about their form 104 filing requirement and the $10,000 trigger. I believe the evidence is going to prove that old Denny knew about the filing requirement, although the Government isn’t really required to prove that Denny was knowledgeable about the structuring laws.

Starting in July 2012, Denny began new pattern of withdrawals. He began withdrawing cash in amounts less than $10,000. The total number of withdrawals was 106, totalling up to $952,000. For now, the Government has alleged the structuring count as a single count. However, if Hastert elect to have a jury trial, I expect there will be many more counts. The reason for this is that each time Hastert makes a suspicious withdrawal it is a violation. And the Government only needs one.

So, it’s like shooting fish in a barrel for the US Attorney’s office. I’m sure there will be some very ugly withdrawals out of the 106 alleged. Will there be cash amounts very close to $10,000 withdrawn on multiple banks all in the same day? I bet you see that type of evidence if Denny goes to trial. And it only takes one instance to for Hastert to be on the hook for a Structuring violation. So, yes, Hastert will be found guilty. And, yes, his attorney will likely tell Hastert that he has zero chance of winning on all counts at trial.

Drop Count One If Pleads Guilty to Count Two?

That brings us to how Hastert may be sentenced if the AUSA drops Count One and allows Hastert to plead guilty to Count Two in exchange for waivers of appeal and trial. I expect that overture will happen at some point. USSG 2S1.3 sets the base offense level at 6 and then adds additional levels using USSG 2B1.1, which is the theft larceny table. In other words, the Guidelines treat all of the funds structured EXACTLY the same as if the funds were stolen funds.

Yes, the guidelines are serious when it comes to structuring funds and folks end up looking at substantial time in prison in these cases. It’s alleged that Hastert structured a total of $952,000. So, that would increase Hastert from a level 6 to a level 20. If Hastert pleads guilty he can get 3 levels off pursuant to 3E1.1 since the total offense level was 16 or higher. That puts Hastert at a level 17. I we look at the above table, Hastert would be look at zone C, 24-30 months. But there’s more meat on the bone. If we look closer at 2S1.3(b)(3), Hastert can get an additional 6 levels off if he can establish:

- The source of the funds were clean. Well, that’s not really in dispute. He made his money from lobbying and that’s still a legal profession.

- He wasn’t reckless about the source of the funds. That is, he didn’t take money from drug dealers to lobby congress. I don’t think that’s an issue here; and

- He MUST show that the money was used for a lawful purposes. In this case, he was paying individual A (maybe a witness) to be quiet. It IS lawful to pay someone to not talk to the media. It is NOT lawful to bribe or influence a witness with money to keep him from reporting a crime. That’s called witness tampering.

If Hastert can establish this 6 level reduction, he’s looking at a level 11. That puts him into zone B, 8-14 months. Certainly, the judge could still sentence him to jail. But the guidelines recommend a probation sentence, perhaps in combination with some house arrest. That’s where I think Hastert’s lawyer hopes this case will end up. But it will likely be a very rough ride getting there.

My Prediction

If Hastert pleads guilty in the scenario I’ve described supra, there will be a big controversy about whether the payments were lawful. I expect the Government will not agree to the six levels off and there may be a massive fight over whether individual A was, in fact, a potential witness against Hastert or just someone Hastert wanted to keep his mouth shut to the media.

It looks like Hastert is way past the Illinois statute of limitations for child sexual assault. I’ve read some folks speculate that Illinois could change the law to prosecute Hastert. But that clearly violates Ex Post Facto, so that WILL NOT happen.

The sentencing will be very interesting indeed. Stay tuned.

Comments are welcomed here and I will respond to you -- but please, no requests for personal legal advice here and nothing that's promoting your business or product. Comments are moderated and these will not be published.

Leave a Reply